ni: Arthur Noel B. Ladaga

Uso na naman ang mga pelikula sa Metro Manila Film Festival. Marami pa rin ang tumatakbo ngayon sa mga sinehan. Maraming dahilan para manood- maglibang, makasama ang pamilya/kaibigan, masilayan ang galing ng Pinoy sa sining ng pelikula atbp. Kung tutuusin, isang beses lang sa bawat taon hindi makakakita ng anumang pelikulang banyaga.

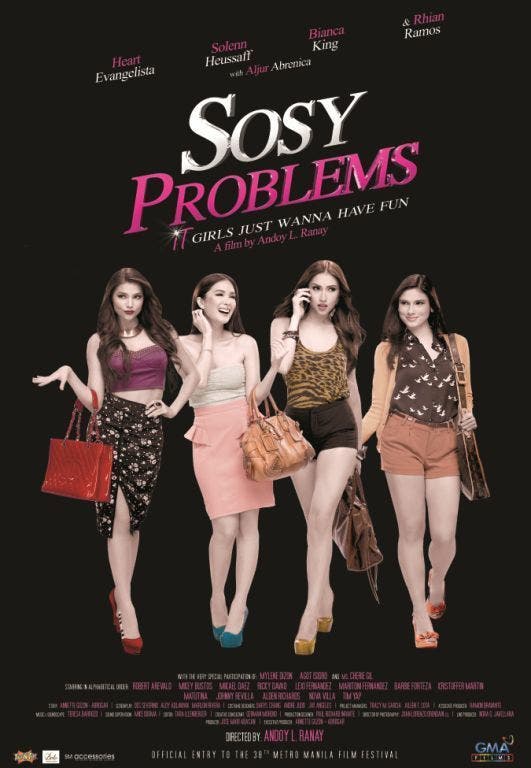

Isa sa mga pelikulang naitampok ay ang Sosy Problems. Pinagbidahan nito nina Heart Evangelista (Claudia), Solenn Heussaff (Margaux), Bianca King (Danielle) at Rhian Ramos (Lizzy). Simple lang naman ang kuwento. May apat na dalagang laki sa layaw na kailangang itigil ang demolisyon ng paborito nilang social club. Hindi nila matanggap na gagawing non-sossy mall ang tambayan nila.

Bagaman walang natanggap na parangal, marami kang mapupulot dito. Halimbawa ay ang mga isyu ng mga taong laki sa layaw. Kung susuriing mabuti, halos lahat ng mga isyung yun ay naka-ugat sa isang bagay: PERA! Ano ba ang mga usapin tungkol sa pera ang makikita sa pelikula? Napakaraming puwedeng makita pero tatlo ang halatang-halata!

- Pagsabay sa uso: Maraming tao ang nadadala rito. Kapag may bagong cellphone, damit, atbp., hindi sila nag-aatubiling bilhin ang mga ito. May isang eksenang nahumaling sina Claudia sa mga mamahaling sapatos sa isang cut-out book. Ang problema sa nakiki-uso ay hindi talaga madalas kailangan ito. Nagagasta lamang ang pera nang hindi pinag-iisipan. Walang masama sa nakiki-uso paminsan-minsan. Ayon kay Francisco Colayco, dapat lang may plano ka at sapat na pagkukunan ng pondo (passive income) maliban sa perang pinagpaguran mo!

- Simpleng pamumuhay: Karaniwan sa pelikulang Pinoy ang tungalian ng buhay siyudad at probinsya. Tulad ng maraming laki sa layaw, hindi sanay si Lizzie sa pagtitiis at pagtitimpi sa probinsya. Ngunit natutunan niya rin ito mula sa kanyang lola (Nona Villa) at pinsan (Barbie Forteza). Maraming tao ang nabubuhay lang ayon sa kanilang mga pangangailangan. Gumastos nang hindi hihigit sa iyong pangangailangan. Live within your means ika nga. Magugulat ka nalang sa dami ng perang maiipon mo!

- Kahalagahan ng pagpaplano: Importante ang pagpaplano sa buhay pinansiyal. Kung kapos ka sa pera, magplano ka para makabangon muli. Nakakagulat na hindi ito ginawa ng mga magulang ni Danielle. Kinukuha na ang kanilang ari-arian, ngunit patuloy pa rin sila sa dating gawi. Ang ama ni Danielle (Ricky Davao), na dating pulitiko, patuloy pa rin sa pag-iinom. Ang nanay naman, gustong sumama sa European cruise. Maayos sana kung nagpakonsulta sila sa isang financial planner (kay Francisco Colayco sana) ngunit hindi. Si Danielle pa ang naglakas-loob para saluhin ang buong pamilya.

Sa madaling salita, may problemang pinansiyal pa rin ang mga taong sossy. Hindi dahil may pera ka ay wala ka nang iisipin. Kung paano mo gagamitin ang pera mo ang magpapalaya sa iyo sa kakapusan. Ito ang susi para yumaman!

Huwag nang magpahuli ngayong 2013! Sumali na sa Pera Mo, Palaguin Mo Workshop ngayong ika-19 ng Enero, 2013. Tumawag sa 637-3731 o 637-3741 para mag-reserba! Pumunta rin sa link na ito para sa iba pang detalye.

*Si Arthur Noel B. Ladaga ay ang kasalukuyang Programs Officer ng Colayco Foundation for Education.

If you are saving but not even meeting your needs, then that is also not good. For example, if you don’t even eat the right kind of food at the right time just to save, you may want to think that over more. If you get sick, then all your savings will go to your medical expenses instead of improving your future.

If you are saving but not even meeting your needs, then that is also not good. For example, if you don’t even eat the right kind of food at the right time just to save, you may want to think that over more. If you get sick, then all your savings will go to your medical expenses instead of improving your future. Investments are TOOLS, and just like any tool you need to know how to use it effectively.

Investments are TOOLS, and just like any tool you need to know how to use it effectively.

Do you know that credit card issuers and their collection agents should observe good faith and refrain from engaging in unscrupulous or untoward acts, to the extent of harassing and humiliating the credit card holder?

Do you know that credit card issuers and their collection agents should observe good faith and refrain from engaging in unscrupulous or untoward acts, to the extent of harassing and humiliating the credit card holder?