by: Art Ladaga

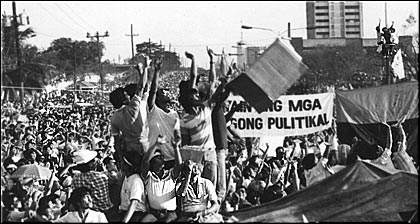

Twenty-seven years ago, the Filipino people triumphed in overthrowing two decades of oppressive dictatorship. Democracy was restored not through guns, tanks, or any military arsenal, but through flowers, rosaries, and one unified desire. People Power I was proof that when people band together- known as the Power of One– they can create miracles and liberate a country from tyranny.

Twenty-seven years after People Power I, many of our countrymen remain within the shackles of financial tyrants. This is the new battle being waged: the battle for financial freedom! According to Francisco Colayco, financial freedom is when you can maintain your desired lifestyle without the need to work. Only in eradicating these three tyrants will financial freedom be realized.

POVERTY: Poverty is a lack of basic necessities, but it is also more than that. According to Nobel Prize laureate Amartya Sen, poverty is also capability deprivation (i.e. not being able to do anything and be productive). One reason why there’s capability deprivation is due to lack of education. Education enables us to recognize opportunities for active and passive income. Sadly, our present educational system grooms us to be hardworking employees. There will come a time that you can no longer work. You might be earning six or seven digit salaries now, but when you retire, you will not be able to maintain your lifestyle without passive income. Thus many people remain poor because they do not know how to utilize earning income actively AND passively!

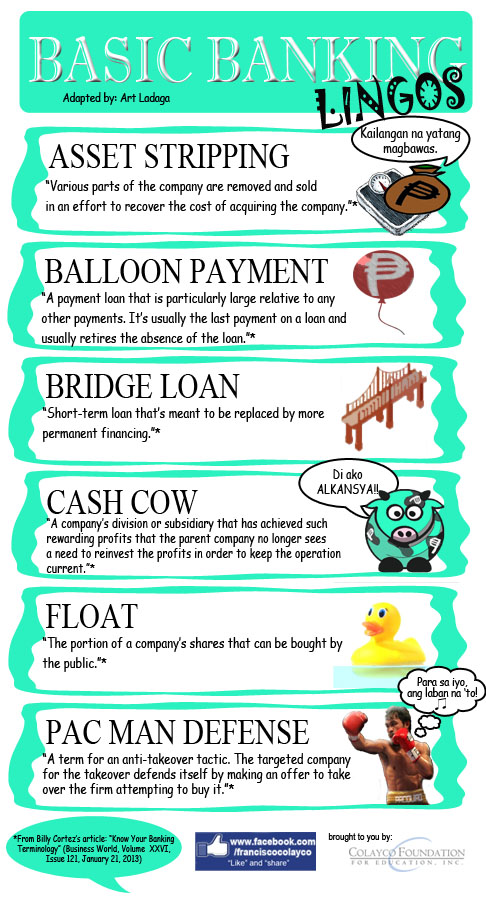

FINANCIAL IGNORANCE: Having a lot of money does not guarantee financial freedom. Knowing how you use and grow it makes a significant difference in your financial life. In a recent study, Citibank reported that the country’s financial score was 53 out of 100. This means that more Filipinos are now becoming savvy in handling their finances. This is definitely good news, but we cannot be complacent.

The massive financial scam in Pagadian City (2012) was a major eye-opener to the dangers of financial ignorance. In the website of Philippine Daily Inquirer, I read about a man in Pagadian City who committed suicide three months ago. He invested all of his retirement money in an opportunity he did not fully understand. When the culprits had gotten away with his money, he experienced depression to the point he decided to end his life! If spending on seminars about money and investing is expensive, financial ignorance is 1000 times more!

GREED: If your only goal in life is having lots of money, you have a major problem! Seeking money for itself poses a real internal dilemma. The Buddha once remarked, “Greed is any imperfection that defiles the mind.” Indeed, how many lives and relationships were ruined because of financial greed? Greed entraps you in a vicious cycle of acquiring. You cannot stop gorging on money because it’s never enough. That is the delusion of it! Eventually you will reach a point that you will internally “blow up,” wrecking your life and the lives of others in the process. In the effort to obtain everything, you lose everything!

The battle for financial freedom is an ongoing-battle. Financial freedom for our countrymen will only be attained through eradicating the three tyrants. Defeating all three is not easy, but it’s not a hopeless cause. Learning from People Power I, only through the Power of One will these three tyrants fall. And it will be possible if all Filipinos will fight as one, under the banner of FINANCIAL LITERACY!

Financial literacy opens the doors to various earning opportunities, thus helping eradicate poverty. You also become more competent and knowledgeable in handling money, thus helping eradicate financial ignorance. And you become goal-oriented in earning money, thus helping eradicate greed. Only through learning proper financial management grounded on proper values can we expect the rise of a ONE WEALTHY NATION!

Thus, THE BATTLE WAGES ON!

Sources:

Alipala, J., & Umel, R. (2012). Teacher kills self after losing all his money in scam. Inquirer Global Nation. Retrieved from http://globalnation.inquirer.net/56146/teacher-kills-self-after-losing-all-his-money- in-scam?ModPagespeed=noscript

Dumlao, D. C. (2013). Filipinos more savvy about finances, study shows. Inquirer Business. Retrievedfrom http://business.inquirer.net/105779/filipinos-financial-quotient-at- record-high-online-poll-shows

*Continue the legacy of EDSA! Achieve financial freedom NOW. Colayco Foundation for Education Inc. is offering two financial seminars this March 23: INVESTability: Stock Market and INVESTability: Mutual Funds. Just click the links for more details about the two seminars.

* Art Ladaga is the current Programs Officer of the Colayco Foundation for Education, Inc.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

I received this comment from “Boy Kamote” on a previous blog when I wrote about how we should teach our children about money.

I received this comment from “Boy Kamote” on a previous blog when I wrote about how we should teach our children about money.

If you are saving but not even meeting your needs, then that is also not good. For example, if you don’t even eat the right kind of food at the right time just to save, you may want to think that over more. If you get sick, then all your savings will go to your medical expenses instead of improving your future.

If you are saving but not even meeting your needs, then that is also not good. For example, if you don’t even eat the right kind of food at the right time just to save, you may want to think that over more. If you get sick, then all your savings will go to your medical expenses instead of improving your future.