by: Francisco J. Colayco

first appeared on GMA News Blog, Sept. 6, 2010

I have lately been getting quite a number of queries on how to make both ends meet. It seems to me that there is a growing desire among the general population to now take hold of their financial lives. This probably has to do with the credit card collection pressures that a good number of income earners are now being subjected to.

There is really no magical solution to this but to accept the reality of your present cash flow. And that simply means reducing your expenses and increasing your income. Easier said than done. And the first step is to budget one’s lifestyle.

Budgeting is always a topic that needs to be revisited. Nobody likes to have to think of a budget. It’s just wonderful to be able to just spend without having to look at the price tag. Fortunately, I have been programmed by what I have been teaching to look at the value for money of anything I buy.

When we were newly married, my wife did not even want to bring me along to do any marketing or shopping because she was afraid I would not know if the price item was too high compared to other stores. She was right, actually. Assessing the value of the prices of goods is really very dependent on practice. If you are not the one who regularly shops for certain types or products, chances are that you will not get the best price. That’s one tip for the family. Each member should be assigned to purchase certain types of products to make sure that the price is right.

Until you are wealthy enough not to have to look at the price tag, you need to have a budget. Let’s review the process of making a budget. Remember that it should always be written down.

You need to make your Personal Financial Plan before anything else. This means that you have a financial goal and you can only have goals if you know where you are starting. You need to know what you own (assets) and what you owe (loans or payables). There are formulas to compute how you can reach your goals. These are in my books or explained in the seminars we give or in our website.

After knowing your goals, you need a clear idea of your income. You need to know what your take-home pay is so you know exactly what you have to spend. Understand all the deductions made from your income whether you are an employee or self-employed. Even in your own business, you should pay yourself a salary and pay the necessary taxes and Social Security, Pag-ibig, Philhealth etc. Understand what kind of benefits you get from each deduction. Taxes are expenses that we all have to pay to run our country. The benefits are the roads, security and similar services that we get. Understand what benefits you get from Social Security, Philhealth and Pag-ibig because these are some kind of insurance or options for loans with reduced interest or even retirement.

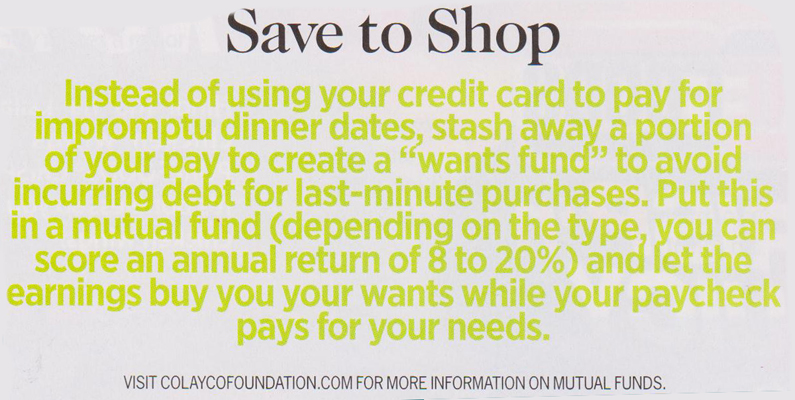

Remember the principle: INCOME MINUS SAVINGS EQUALS EXPENSES. You already know your income as we discussed in the last article. Now make a simple list of your expenses.

Divide your expenses into those that are the same every month such as rent or loan amortization. Then, the others are those that change every month such as electricity, food. It becomes very clear that for the fixed expenses, you cannot easily reduce without doing something drastic. For example, you may need to move to another house if you want to reduce your rent or sell your house to remove your housing loan.

For the expenses that can change every month, you will find it much easier if you know in detail how much you spend for each category. For example, “food” is a general category but it could include junk that you really don’t need. Have a pocket “spending notebook” and just jot down every amount that you pay out including payment for a bottle of water, a bag of peanuts, a piece of candy, bus ride etc. When you go to the grocery, you should have a specific list of what you can buy.

If you are trying to understand your food (or any other category) budget for the first time, you can do this. Spread all the items you bought on the table and think carefully whether each item is a “need” or a “want”. Remember that a need becomes only a want if there are options to “downgrade” to a less expensive brand or type for the same item. For example, fresh foods are usually cheaper than processed foods.

Involve your family in making your budget and assign each to be the “authority” in prices of items that you regularly buy. The person in charge should keep himself always aware of the changes in the prices and where to best buy them. Remember though to input the cost of transportation when you find that a certain item is cheaper in a place far from your home.

There is no right or wrong in making a budget. Each person or family has different priorities. One prefers to always eat the better food and just stay at home and one would rather have fun outside and hardly eat. You need to plan together, understand and respect each other’s needs.

While you are finding ways to decrease spending, find ways to  increase your income. Sometimes people are bogged down by their mindset on what they can or cannot do. This is especially true in the Filipino culture where those who took up a college degree feel that they should only be in a white-collar job. Our system of having house help readily available helps in developing the mindset from a very young age. In western countries and more developed countries, every person has to do his share in the housework from childhood. Therefore, everyone doesn’t think twice of doing any kind of work.

increase your income. Sometimes people are bogged down by their mindset on what they can or cannot do. This is especially true in the Filipino culture where those who took up a college degree feel that they should only be in a white-collar job. Our system of having house help readily available helps in developing the mindset from a very young age. In western countries and more developed countries, every person has to do his share in the housework from childhood. Therefore, everyone doesn’t think twice of doing any kind of work.

Given an open mindset and humility to doing any kind of work, surely you can find a sideline to add to your income. For example, doing simple home repairs, cooking meals or landscaping for others can be good options especially for those who are looking for people they can trust. If you are too proud, you can start as a hobby and slowly charge a fee as you gain a good reputation. There are other talents you can use like teaching a musical instrument, writing, tutoring etc. In the beginning, this will surely not earn much but do the best job you can even if it pays for only a meal at the start. It can develop into a full-time business in the future. There is so much that can be done but in the final analysis, reputation will carry you through success.

To summarize your budgeting effort:

1. Keep a record of your daily spending. Have a small notebook and pencil always with you and jot down any expense immediately.

2. Understand your real cash-flow income and expenses at least a month ahead of time. If you have a partner or family, make sure you all agree with how you are going to spend the money.

3. Reduce spending in a very studied method. Be creative with the ways you can cut expenses each week and practice until you get the hang of it.

4. Keep track of your budget weekly and monthly so you can make adjustments. There will always be unplanned situations. Life is really like that. For example, when you are on a road that suddenly gets blocked, you will find a way to go around the block. It is the same with your budget. Be ready with options.

“May the Grace and Peace of the Lord be with you! I just want to express to you my joy and appreciation. I have attended the talk given by Mr. Armand Bengco to our clergy for our day of recollection. That talk paved the way for me to discover you and your Foundation. I also bought a set of books you authored. After having read your books I want to tell you that I have learned a lot from you. You have the wisdom to teach people how to improve their lives and you know exactly how to do it in a manner that is enjoyable yet profound. Since I became a priest in 1990 one thing I felt I needed so badly is financial literacy. Now that I’m in my 21st year in the ministry I got the answers I have been longing for from your books. I’m definitely sure you have already helped a lot of our kababayans. I wish you all the health in spirit, soul, mind, and body so that you may continue doing that unique service to our people. You are God’s gift to our nation. Salamat po! Oh, by the way, I’m interested in joining the KSK soon. I wish to meet you personally sooner or later when time allows. Be assured of my prayers!”

“May the Grace and Peace of the Lord be with you! I just want to express to you my joy and appreciation. I have attended the talk given by Mr. Armand Bengco to our clergy for our day of recollection. That talk paved the way for me to discover you and your Foundation. I also bought a set of books you authored. After having read your books I want to tell you that I have learned a lot from you. You have the wisdom to teach people how to improve their lives and you know exactly how to do it in a manner that is enjoyable yet profound. Since I became a priest in 1990 one thing I felt I needed so badly is financial literacy. Now that I’m in my 21st year in the ministry I got the answers I have been longing for from your books. I’m definitely sure you have already helped a lot of our kababayans. I wish you all the health in spirit, soul, mind, and body so that you may continue doing that unique service to our people. You are God’s gift to our nation. Salamat po! Oh, by the way, I’m interested in joining the KSK soon. I wish to meet you personally sooner or later when time allows. Be assured of my prayers!”