by: Francisco J. Colayco

(Still a very relevant article considering February is fast approaching!)

December and January are the most popular months for weddings in the Philippines. This is probably because the weather is cooler. It is nice to sing “Santa, make me his bride (make her my bride) for Christmas.” It is wonderful to start the New Year with your most beloved in the entire world!

I received an email about why the wedding ring is worn on the fourth finger. We have five fingers.

– The Thumb symbolizes our parents.

– The Forefinger symbolizes our siblings.

– The Middle Finger symbolizes ourselves.

– The Ring Finger symbolizes our spouse.

– The Little Pinky symbolizes our children

Put your hands and fingers together as in prayer. Then, fold your middle fingers inward so that the outside of each knuckle touches each other. Keep the tips of the other fingers touching each other. While making sure that the middle fingers continue to be folded touching, try moving the other fingers:

– You can move your thumbs showing that your parents can leave you.

– You can move your forefingers showing that your siblings can leave you.

– You can move your pinkies showing that your children can leave you.

– But try moving your ring fingers and you can’t.

Marriage is permanent but while you are not yet married, this article might prove useful for you.

We all know that the engagement period is the time to really get to know each other before marriage. But couples who become engaged seem to think that they cannot break the engagement, if necessary. Should the couple see “substantial differences” in thinking, this period is the time to understand those differences before they become “irreconcilable differences”, which become the reason for many separations and annulments. Do not believe that you can change your partner once you are married. For most, the marriage makes the partner even more fixed in his/her ways.

So many engaged couples are embarrassed to discuss money matters before they get married. Based on my experience, if you cannot discuss financial matters with your loved one before you get married, it is almost inevitable that you will have problems related to financial matters during your married life. It is not the amount of money that you have that matters but what you intend to do with it and how you expect to manage it. You could be very lucky and have all the money you will ever need until you retire. However, nothing is sure in this world and all of that could easily be lost with wrong management of finances.

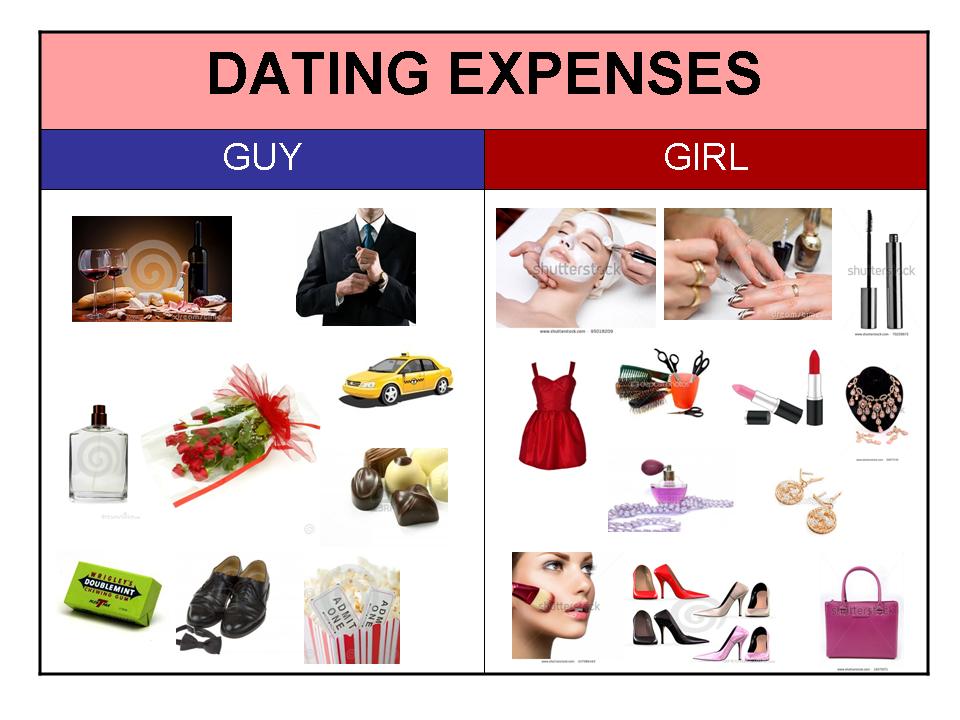

YOUR VIEWS ON MONEY

Many times, the family environment you grew in will dictate your reaction to money. One of you may be always saving or even downright stingy and the other might not care about money and may even be a spendthrift. During the courtship period, your real personalities may not be immediately obvious since you are trying to show your best side. I suggest that you tell each other frankly how you view money. Ask each other how you will view your success and the role of money in that success. If it turns out that your ideas about finances are not compatible, both of you will have a better understanding on how to accept each other for what you are or to agree on how you will both overcome the differences. There is also the option to postpone the marriage or cut the relationship if the issues are truly irreconcilable and you can see that love might not be enough, in the long run.

AGREE ON YOUR LIFESTYLE

Understand how much money and also how much debt each of you already have. If there is debt, you have to agree on how it will be paid. Be open about how much each of you earns and what you expect to be spending as a married couple. Do not leave the decision of what to spend on a day-to-day basis. This could lead to unnecessary misunderstandings on how much each should be spending on specific items. Having a budget will help you agree on the kind of lifestyle you should live to be able to reach certain goals. For example, you can aim to have a car within a year, a house within five years etc.

Having children is also another matter that has to be discussed in relation to finances. How you raise your children will depend on the time you will have. If both of you have to work for your chosen lifestyle, obviously, you will have to share the raising of your children with yayas or your parents.

HOW WELL DO YOU UNDERSTAND PERSONAL FINANCE

As I have seen time and again, parents and schools rarely teach personal finance. Even finance students and employees do not know how to manage their personal finances. They may be very good in their theoretical studies and in their actual jobs related to finance but that is not what personal finance is all about.

I have many friends who give my books as wedding presents. I am happy that the couple will have some guidance during their married life but it would have been better if they had been given the books before or when they became engaged. The books will help them understand how they can save and grow their savings. With these books, they can discuss and mutually agree on the type of investments they would choose both for the short-term and for the long-term. You can also join our Pera Palaguin Seminars that we hold regularly.

WHO WILL BE RESPONSIBLE FOR KEEPING THE MONEY

Even if financial wellbeing is a joint undertaking, one of you has to be responsible for:

– Staying within the agreed budgets. Informing the other when there is any possible deviation foreseen.

– Keeping track of all important documents and records such as your marriage license, passports, Income Tax Returns, insurance policies, investment certificates, etc. Decisions on Insurance, Investments and Income Tax Returns filing should always be done jointly in consultation with experts.

– Properly maintaining and balancing all bank accounts to prevent penalties and not allow cash idle without earning any interest. The matter of keeping joint or separate accounts or a combination of the two is a choice that the couple should agree to. They should be open with each other with their reasons.

Of course, these activities can move from one to the other, say one year each. This way, both of you learn and have a good understanding of your financial situation. This is especially important in case of emergencies where one is not available.

WHO WILL PAY FOR THE WEDDING

There used to be a rule where, in the Philippines, the groom’s family pays for everything and in the United States, the bride’s family pays for everything. Today, the best solution is for the couple to pay for everything. The families of both the groom and the bride can give whatever monetary gift they can afford. From the gift, the couple can decide on how much they want to spend for the wedding itself.

I always admonish couples not to spend too much on their wedding day. It is only one day and they have the rest of their life together to look forward to. The rest of their life together is definitely more important. They should not try to keep up with their friends who got married before them. Parents should respect the decision of their children.

COMMIT TO DISCUSS MONEY REGULARLY

Differences are inevitable. Work on a program of continuing discussion and communication with an open mind and sincere heart. Bring in an objective and experienced financial adviser if your differences seem to be major. This is key to your long-term financial compatibility.

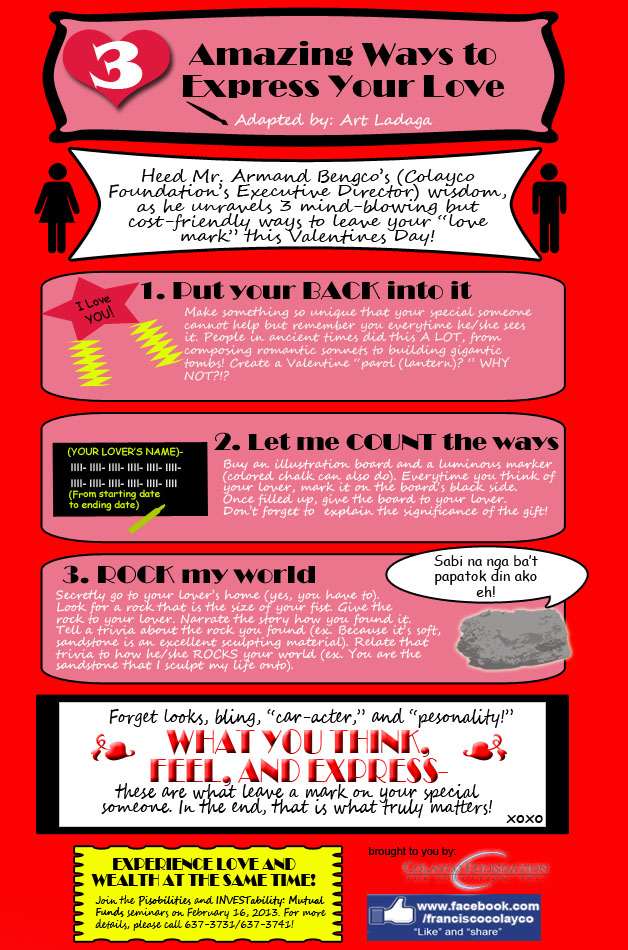

LOVE OR WEALTH? WHY NOT HAVE BOTH! To know how, join Colayco Foundation’s Pisobilities and InvestABILITY: Mutual Funds seminars on February 16, 2013! Click the links below for more information about the two seminars:

Pisobilities

InvestABILITY: Mutual Funds

For reservations and inquiries, please call 637-3731/637-3741. Look for Ms. Lala!

* Article first appeared on the GMA News TV Blogsite

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.

Of course our excitement was and still is pitch high and this article that just reached me is a perfect way to share with you what kind of a person Suze Orman is. I am definitely proud to have been singled out by her during that talk and I look forward to a collaboration with her on our common mission.